When considering trade school as a viable option for career advancement, it's important to approach the decision with a smart financial plan. Trade schools offer a wide range of programs that can help individuals acquire in-demand skills and increase their earning potential. However, the cost of attending trade school can be a significant barrier for many students.

To maximize your investment in trade school, it's crucial to understand the costs involved and create a personalized financial plan. This plan should take into account the total cost of attendance, including tuition, fees, and materials, as well as any potential financial aid or scholarships that may be available.

Understanding Trade School Costs

The cost of attending trade school can vary widely depending on the program and institution. On average, trade school programs can range from a few thousand dollars to over $20,000 per year. It's essential to research the specific costs associated with your desired program and factor these into your financial plan.

In addition to tuition and fees, you should also consider the cost of materials, equipment, and any necessary certifications or licenses. Some trade schools may also offer financial aid or scholarships to help offset these costs.

Creating a Financial Plan

To create a smart financial plan for trade school, you'll need to consider several factors, including:

-

Your current income and expenses

-

The total cost of attendance

-

Any potential financial aid or scholarships

-

Your expected earnings after completing the program

A financial planner can help you navigate these factors and create a personalized plan that meets your unique needs and goals.

Exploring Financial Aid Options

There are several types of financial aid available to trade school students, including:

-

Federal Student Aid: The U.S. Department of Education offers several types of federal student aid, including grants, loans, and work-study programs.

-

Scholarships: Many trade schools and organizations offer scholarships to students pursuing specific programs or careers.

-

Private Loans: Private loans are available from banks, credit unions, and other lenders, but often have higher interest rates and less favorable terms than federal loans.

Career Readiness and Job Placement

Trade schools often have strong relationships with local employers and can provide job placement assistance to graduates. This can be a significant advantage when entering the job market.

Many trade schools also offer career readiness programs and services, such as resume building, interview preparation, and job search assistance.

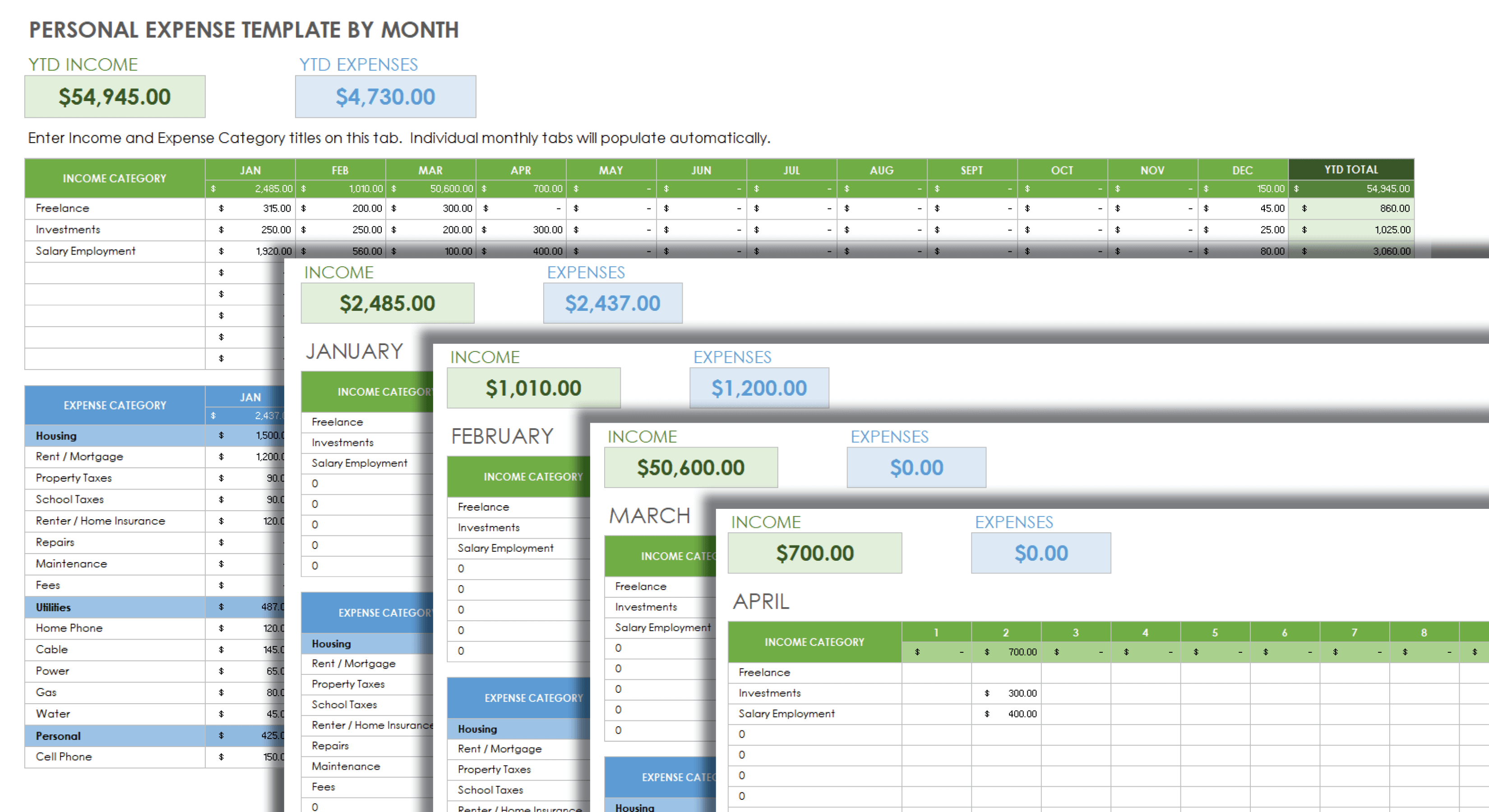

Managing Expenses and Budgeting

To get the most out of your trade school experience, it's essential to manage your expenses and create a budget that works for you. This may involve:

-

Tracking your income and expenses

-

Creating a budget that accounts for all necessary expenses

-

Making adjustments as needed to stay on track

By carefully managing your expenses and creating a smart financial plan, you can maximize your investment in trade school and set yourself up for long-term success.

Job Search and Career Advancement

After completing trade school, you'll be ready to enter the job market and start your new career.

Many trade schools have career services that can help you find job openings and prepare for interviews. You can also use online job search platforms and networking events to connect with potential employers.

Collaboration and Community

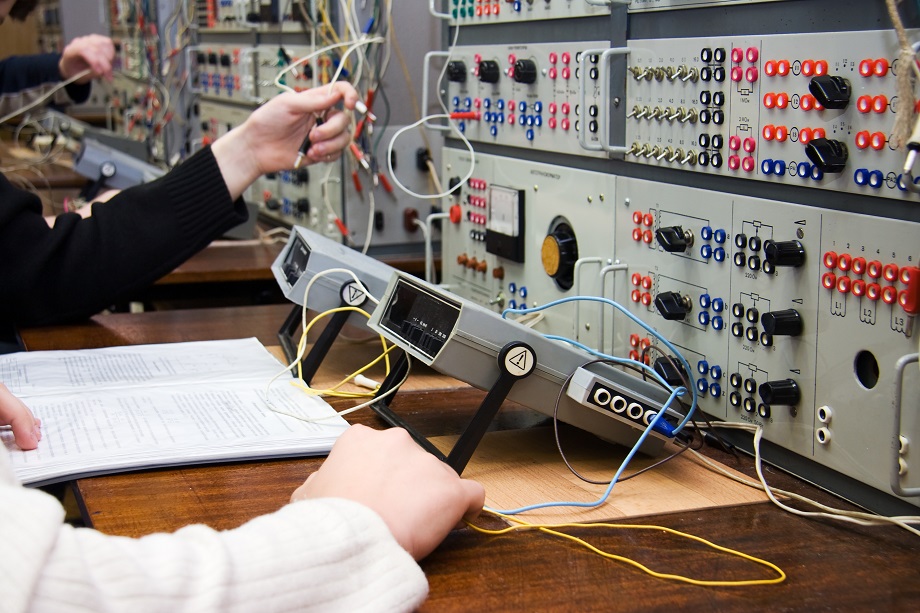

Trade school is not just about individual achievement, but also about being part of a community of learners and professionals.

To gain valuable insights and build relationships that can last a lifetime, collaborate with your peers and instructors.